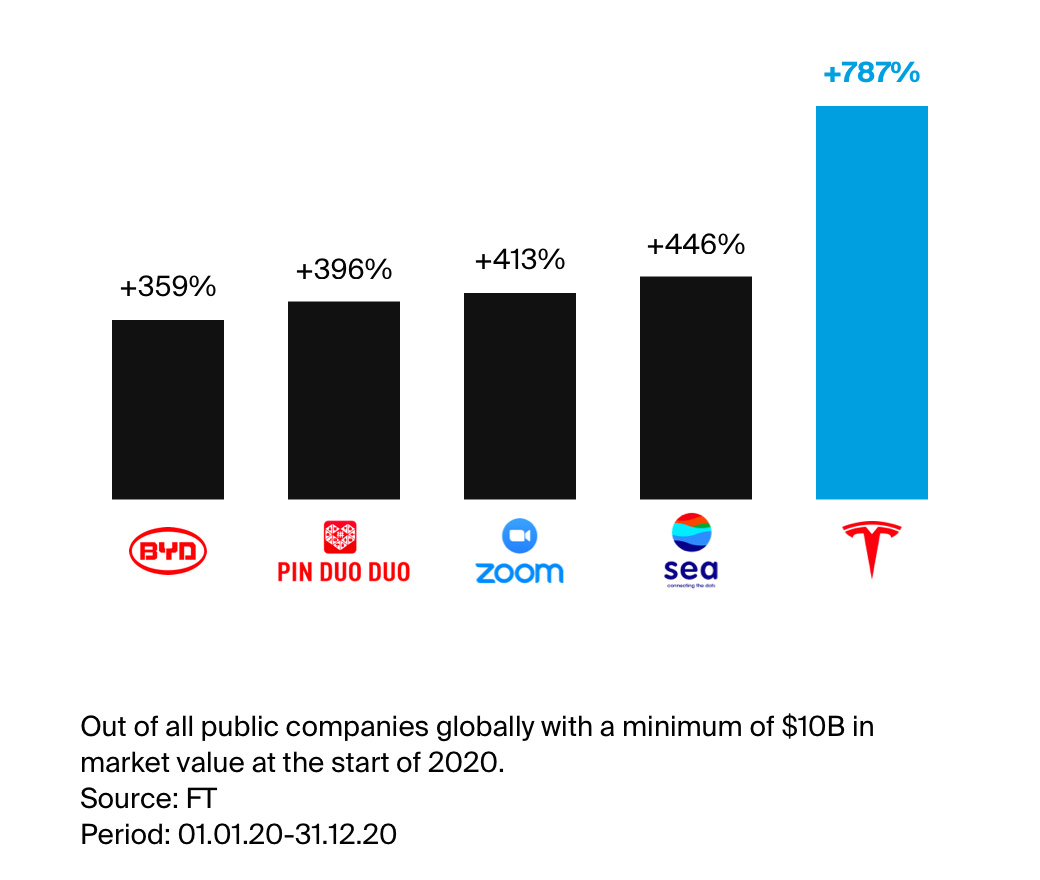

Some companies stock prices soared last year amid the Covid-19 pandemic. Keep reading to find out which company’s stocks gained the most.

Biggest price gains

The Financial Times recently published a report ranking the top 100 companies that saw the biggest price increases during 2020. In its analysis, the Financial Times looked at every public company with a market value of at least $10 billion at the start of 2020. We zoom in on the top five, which are all either American or Asian companies.

1. Tesla

While investors and analysts alike often debate if Tesla is overvalued or not, it is without question that the electric car maker had an impressive run in 2020. Prices climbed by 787%, ending the year with a $669 billion market cap. To put this staggering amount into perspective, in December 2020, Tesla’s market cap was greater than that of Toyota, Daimler, General Motors, Volkswagen, BMW, Honda and Ford combined.

Aside from becoming the most valuable car company, Tesla’s stock made headlines for many other significant events. To name a couple, in August 2020, Tesla announced a five-for-one stock split, citing that it would make stock ownership more accessible to employees and investors. It also made history in December 2020 as the most valuable company to join the S&P 500.

Tesla released its fourth quarter results at the end of January 2021. Some highlights were that it was Tesla’s first annual net profit ever, and there was a record amount of vehicle deliveries on a yearly basis.

2. Sea Group

Sea Group takes the number two spot, with prices increasing by 446%. If you are unfamiliar with Sea, it is a leading consumer internet company based in Singapore.

The company operates three core businesses: Garena, Shopee and SeaMoney. Garena is a global online games developer and publisher, creating popular games such as League of Legends, Free Fire and Call of Duty Mobile. Shopee is its e-commerce shopping platform and is the largest pan-regional platform of its kind in Southeast Asia and Taiwan. Lastly, SeaMoney offers digital payments and financial services in Southeast Asia.

In the third quarter of 2020, the three segments of Sea’s revenue, Digital Entertainment, E-commerce & other services and Sales of goods, all saw significant year-over-year increases of 72.9%, 113.1% and 199.3%, respectively. Total revenue increased by 98.7% year-over-year, and gross profit approximately doubled.

3. Zoom Video

With stay-at-home orders forcing people to rely on online communication platforms for work, school and/or social calls, Zoom became a rising star. Prices for the video conferencing company surged by 413% last year.

Zoom measures its customers as companies with more than 10 employees. At the end of Zoom’s third fiscal quarter, which ended 31 October 2020, the company had 433,700 customers. This is a 485% increase from the same quarter in the fiscal year prior. Revenue growth was also three-digits. Revenues were $777.2 million, a 367% increase year-over-year.

4. Pinduoduo

Pinduoduo was another company that saw share prices skyrocket amid the pandemic, as prices increased by 396%. Pinduoduo is based in Shanghai and is China’s third-largest e-commerce platform, trailing behind Alibaba and JD.com.

Aside from a wide range of products offered, from fresh produce to electronics, Pinduoduo’s app has social components, one of which is referred to as a ‘team purchase model’. When a Pinduoduo user chooses an item to buy, they can participate in team buying. The user then shares their purchase with family or friends on social networks, and then a team is created within 24 hours. The more people that join in, the more the item is discounted.

Pinduoduo reported strong growth in revenue and users in its third quarter 2020 results. Revenues were RMB14.2 billion (≈$2.2 billion) [1], up 89% year-over-year. Average monthly users (MAUs) increased 50% year-over-year, with a total of 643.4 million.

5. BYD

Last but not least is BYD, increasing by 359%. BYD, which stands for Build Your Dreams, is a Shenzen-based company and backed by Warren Buffet. It is primarily engaged in the manufacture and sales of transportation parts and equipment.

It has a broad portfolio, including passenger vehicles, commercial vehicles, rail transit equipment, batteries, consumer electronics and more. Although its product offering varies from 2020’s biggest winner, Tesla, it is a competitor in electric vehicles (EV). Bloomberg reported at the end of December 2020 that Tesla led EV sales in China, followed by BYD.

In its third quarter results, the company reported a 41% increase in sales and a 1,362% increase in net profit, year-over-year. At the time of writing, BYD is China’s largest carmaker by market value.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Please be aware that facts may have changed since the article was originally written.

Deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.

Sources: Financial Times, S&P Global, Bloomberg, Reuters, Yahoo Finance, Tesla, Sea, Zoom, Pinduoduo, BYD, TechCrunch

Exchange rate as of 27.01.21:

1 1RMB=0.15 USD