What is fundamental analysis and how does it work?

Once you have a ESKIMO account, you instantly gain access to over two million financial instruments at the push of a button. What to do next is the big question. Many people already know what they want to invest in. Others want to spend some time researching where they want to put their money.

When it comes to picking stocks, there are two schools of thought on how to go about things: technical and fundamental Analysis. In this article, we will explain fundamental analysis. Read our article about technical analysis here.

Fundamental analysis

Fundamental analysis is a methodology of techniques used to identify trading opportunities by analysing trends focussing on patterns. Investors use fundamental analysis to calculate the true underlying value of a stock. By using key publicly disclosed figures, you calculate whether or not a company is a worthy investment.

These figures typically come from three distinct but interconnected reports that a publicly-traded company will release to their investors in quarterly or annual reports; the balance sheet, the income statement and the cash flow statement.

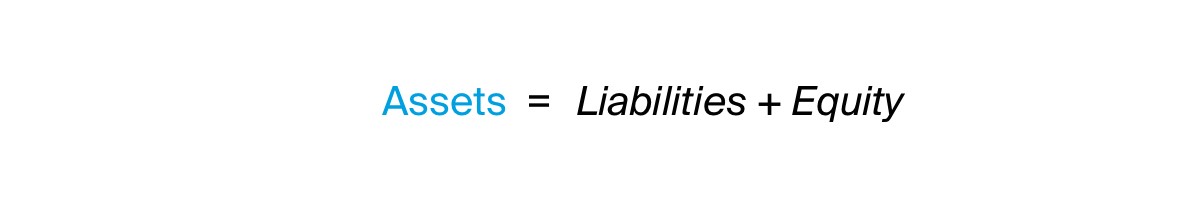

- The balance sheet summarises a company’s assets (resources that hold some economic value to the company), liabilities (obligations that the company has to pay off) and equity (the net value of the company). The formula which ties these three aspects of a company is as follows:

- The income statement (also known as the P&L statement) compliments the balance sheet in an annual report. This will show the company’s revenue and expenses during a specified period. Key figures reported on an income statement include the sales (or revenue), profit and earnings per share.

- Finally, the cash flow statement looks at all the ways cash comes into and goes out of the company. While similar to the aforementioned income statement, the cash flow statement is less a performance report than an accounting history. Cash flows will typically come from three areas of the business; operating, investing and financing.

All three of these reports are typically found in the annual report of a company as a way to stay transparent to shareholders and the general public about the state of their operations. More complicated models can also take into account external factors, such as macroeconomic conditions or fiscal policy. However, for this introduction, we will limit our analysis to an analysis using only company data.

Key figures

There is a wealth of information available about publicly traded companies, which can be easily found online. Some of these statistics (such as the number of employees and profit) are quite self-explanatory. But there will also be more complicated figures and ratios, which aim to give an interpretation of an aspect of a company’s financial performance. We will go over a few of the more popular ones here.

Market cap – Market capitalisation is the total value of a company’s outstanding shares at a point in time.

This figure is important to determine if a company is classified as large-cap, mid-cap or small-cap. Large-cap companies are often considered to be companies with a market cap of over $10 billion. Mid-cap stocks have a market cap between $2 billion and $10 billion, while small-cap stocks are between $300 million and $2 billion.

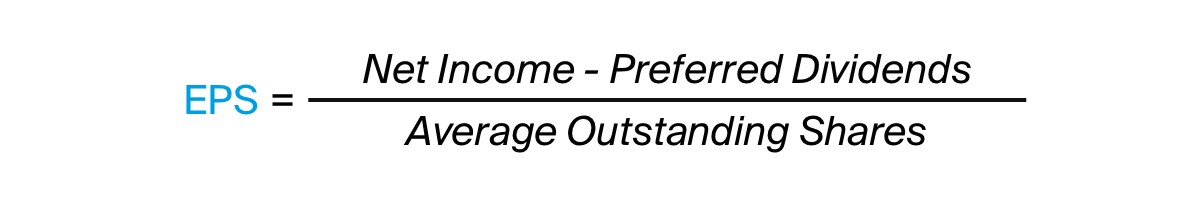

Earnings per share – Earnings per share (EPS) is the amount of profit per share of outstanding company stock. As the name implies, this would be the total value that each share brings to the company. An EPS of £5.00 means that each share issued nets the company £5.00 of net income.

As there is no general benchmark, EPS is open to interpretation. A high EPS is a sign of high earnings. For more meaningful results, emphasis should be put on a long-term analysis to see the earning power of the company over time, as well as a review of EPS of other companies in similar industries.

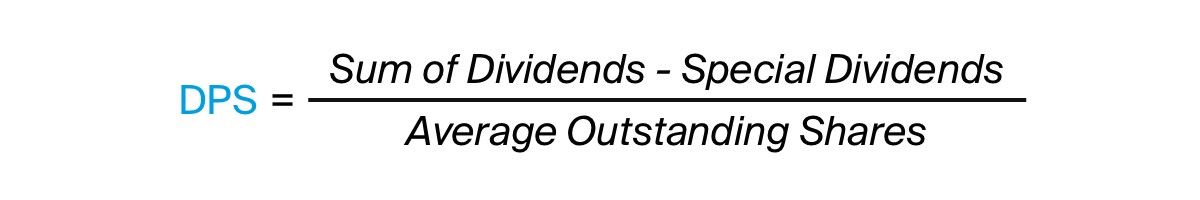

- Dividend per share – Like EPS, dividend per share (DPS) is a key figure which aims to give a simple calculation for the earning power of a company. DPS is the number of dividends paid per share.

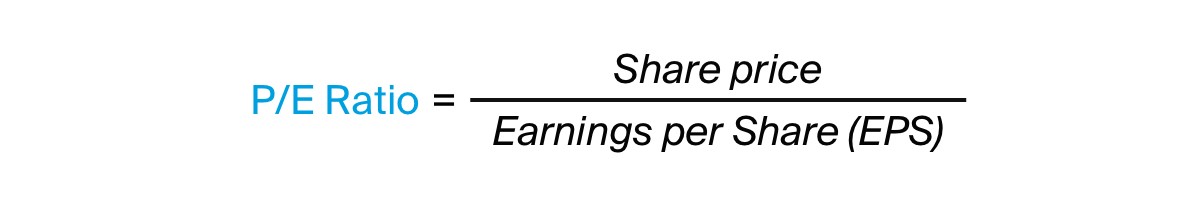

- Price to earnings ratio - Perhaps the most well-known of all key ratios is the price-earnings or P/E Ratio. The P/E ratio is expressed as a multiple of the company’s share price relative to its per-share earnings. The P/E ratio is also known as the price multiple.

For example, if a company’s share price trades for £10.00, and the calculated EPS is £2.00, the company P/E ratio is 5.

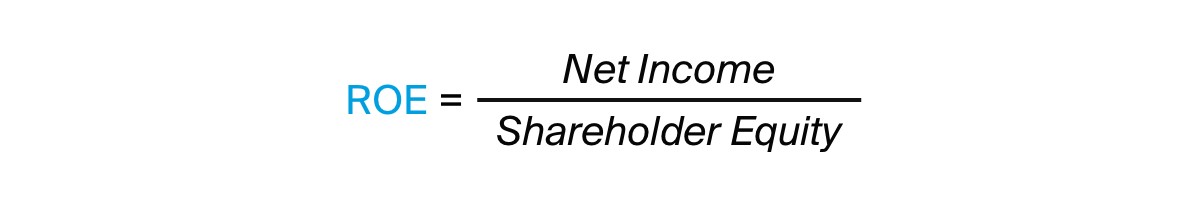

- Return on equity - The last of the key figures is the return on equity. ROE is the ratio of income relative to shareholder equity outstanding. This shows a company’s profitability (earning power) generated from invested capital.

For example, if a company earned £10 million in total income during a year where shareholder equity amounted to £25 million, then the ROE would equal 40%.

Like the other ratios, ROE is best examined in relation to a company over time and in relation to an industry. A company with a raising ROE over time can indicate an increase in efficiency (higher profit with the need for less capital invested).

Limitations of fundamental analysis

Fundamental analysis is a method, but it has its limitations. One of them is the fact that the efficient-market-hypothesis (EMH) contradicts this method. This economic principle states that market prices reflect information from the past. Therefore, there is no benefit in analysing trends focussing on patterns. Next to that is the self-fulfilling aspect of fundamental analysis. When enough people use the same signals and input to decide what stocks to buy, they could cause the expected movement themselves. This will create a snowball effect.

Lastly, it is important to understand how fundamental analysis works before applying it with actual money to avoid losses. It is a good idea to experiment with a number of strategies and use the indicators in combination with one another in order to yield meaningful results when trading. At ESKIMO, we are open and transparent about the risks that come with investing. Before you start to invest, there are a number of factors to consider. It helps to think about how much risk you are willing to take and which products match your knowledge. Additionally, it is not advisable to invest using money that you may need in the short term or to enter into positions which could cause financial difficulties. It all starts with thinking about what kind of investor you want to be.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products that match your knowledge and experience.

Start investing today.

Start investing today.

- Incredibly low fees.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.