What is an investment fund?

An investment fund is often described as a basket of shares (or other financial products). When you participate in an investment fund, an investment fund manager invests your money for you. They will analyse the stock market and buy or sell for the fund, based on the outcome of their research. This also marks the difference between ETFs and investment funds. Typically, an ETF is set to track an underlying such as an index. Usually, they are not actively managed by a fund manager. Funds can invest within a theme, such as emerging markets, or for example, the fund can have a focus on a specific geographical region. A combination of different investment categories is also possible.

How do investment funds work?

Investment funds have stocks, bonds or other financial products of several companies in its portfolio. So, if you participate in such a fund, you automatically invest in several companies at the same time. The advantage of a large spread is in regard to diversification. When one stock has a disappointing return, this has a limited influence on the return achieved by the complete fund. On the other hand, positive outliers can also have a limited influence on the overall result.

The fund manager determines the composition of the fund. He or she determines which shares to invest in. As an investor (or participant of the fund), you have no influence on the composition yourself. In the European Union, it is a legal requirement for a fund manager to provide a Key Investor Information Document (KIID) for UCITS funds. For non-UCITS funds, a Key Investor Document (KID) is required according to the PRIIPs regulation. This information is often available on the website of the relevant fund and in our trading platform. The document describes the most important information, such as the composition of the fund, the costs, the past performance and the distribution percentages. It can be essential to make a well-considered decision when choosing an investment fund. Sometimes, for example, a minimum investment is required to join an investment fund. If this applies, it is clearly stated on its website.

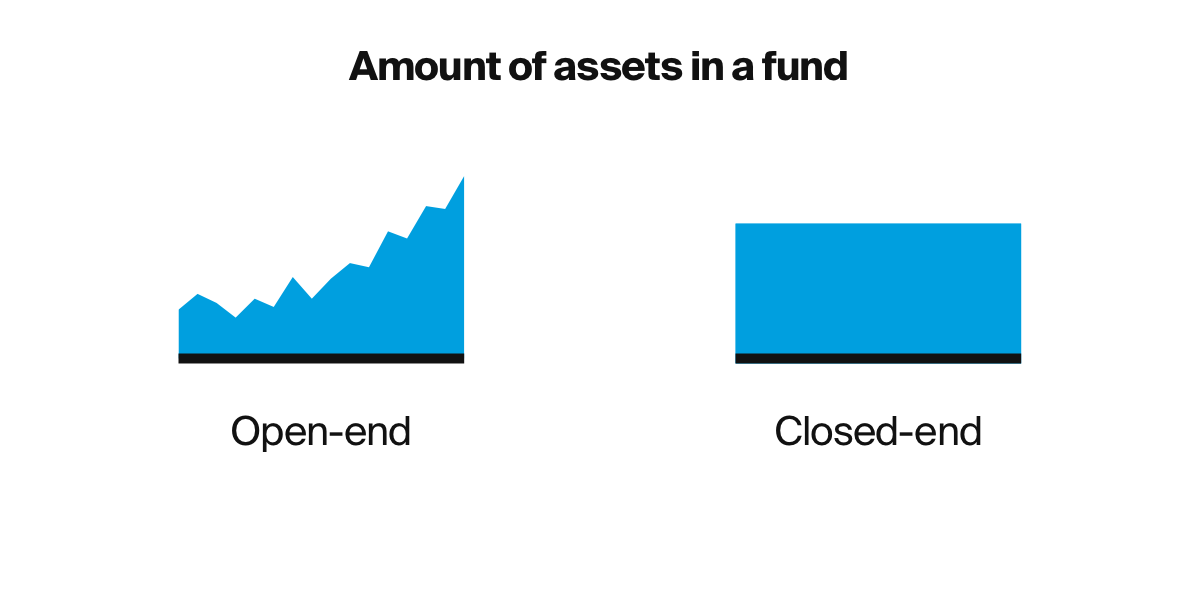

Open-end and closed-end investment funds

Investment funds can be open-ended and closed-ended. Typical for an open-end fund is that the fund manager is only allowed to expand the basket of shares when new money arrives. Open-end funds always note the Net Asset Value (NAV). The price of an open-end fund depends on this NAV. The vast majority of investment funds are open-ended. This means that they can create more shares when desired. In contrast, the number of shares is fixed for closed-end investment funds. The price of a closed-end fund is determined by the supply and demand in the fund. When placing an order for a closed-end investment fund, it is important to determine in advance how much you are willing to pay or wish to receive. A limit can be specified if desired.

The costs of investing in an investment fund

Investment funds are typically actively managed by a fund manager, which comes at a price. These costs are included in the price of the investment fund. Most of them charge between 0.5%-2.0% on an annual basis. It is important to check this before investing, as ongoing charges can impact returns on investment. The exact costs are stated in the KIID or KID and the Prospectus. You can find these documents within the ESKIMO platform when you select an investment fund and then select ‘Documents’. In addition to the intrinsic costs, your broker charges transaction costs for the purchase and sale of your position. Please see ESKIMO’s fees in our Fee Schedule.

Different types of funds

There are many different types of investment funds. Some of the main ones are equity funds, bond funds, mix funds, hedge funds and index funds. Below are short explanations per type of fund, so that you can compare the various types.

-

Equity funds

invest in shares of listed companies. These funds are generally aimed at a specific region, sector or theme. -

Bond funds

invest in corporate, government and semi-government bonds. Risks with such funds are often very limited as governments generally meet their obligations, but of course, investing in bond funds is not without risk. -

Mixed funds

make a combination of shares and bonds. Because of this combination, risk is lowered due to the diversification in product types. Of course, this does not mean that these funds are risk free. -

Hedge funds

often invest in many different instruments and derivatives. This way, they can try to hedge risks or achieve higher returns. -

Index funds

follow the composition and performance of an index, such as the S&P 500. This type of fund is designed to match the risk and return of the relevant market.

The benefits of investing in an investment fund

- By investing in an investment fund, you benefit from the knowledge and expertise of the fund manager. The fund manager is supported by several specialists.

- You have the option of investing in a very diversified manner with relatively little money. Generally speaking, the greater the diversification, the smaller the risk.

- As a private investor, it can be difficult to enter certain markets and sectors. Certain investment funds may provide you with access to more markets.

- If you were to buy a basket of shares yourself, you would often spend more on transaction costs than if you did this through an investment fund.

Disadvantages of investing in an investment fund

- Despite the expertise of the fund manager and the specialists, a negative return is possible.

- The ability to trade is often only 1x per day or less. The price of the fund is also adjusted only once a day.

- Because investment funds must be maintained by specialised personnel, the costs are generally much higher than the costs for ETFs that passively follow an index. These higher costs, unfortunately, do not provide assurance on better results.

Risk of participating in an investment fund

Participating in an investment fund can be beneficial, but it is not without risk. At ESKIMO, we are open and transparent about the risks associated with investing. When an investment fund is well spread, the risk is often relatively limited. However, investing always involves risks. Please note that most investment funds are not traded often. For most funds, this is once a day, but some funds trade once a week, once a month or even less. Oftentimes, your order must be given a day in advance for a certain time to be taken at the next day's trading time. The time at which your order must be placed depends on your broker. You can find the exact time when trading the fund can be found in the Fund's KIID.

While a higher risk investment fund may have the potential of a higher return, there is no guarantee of this. The higher the risk associated with a particular fund, the higher the risk is of losing your investment.

Please note that most investment funds are not traded often. For most funds, this is once a day, but some funds trade once a week, once a month or even less. Oftentimes, your order must be given a day in advance for a certain time to be taken at the next day's trading time. The time at which your order must be placed depends on your broker. You can find the exact time when trading the fund can be found in the Fund's KIID or KID.

In both the prospectus and KID or KIID you can also find information about the risk of a specific fund. The risk indicator in the KID or KIID rates the risk of a fund between one and seven. Within this ranking, one is the lowest risk level and seven is the highest. There are different methods that are used to calculate the risk indicator.

Which investment funds does ESKIMO offer?

ESKIMO offers funds from many different fund houses. Some well-known fund houses are:

- Aberdeen standard

- BNP Paribas

- Blackrock

- Fidelity

- Goldman Sachs

- Kempen

- NN (former ING investment funds)

- SNS investment funds

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Please be aware that facts may have changed since the article was originally written. Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products that match your knowledge and experience.

Start investing today.

Start investing today.

- Incredibly low fees.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.