Bottled beverages have been available to consumers for centuries. First, they were available in glass bottles and later in steel and aluminum cans. However, it wasn’t until the 1970s when the introduction of PET plastic bottles made the bottled water industry take off. According to Allied Market Research, the bottled water industry had an estimated value of $169.8 billion in 2015 and is expected to grow to $319.8 billion in 2022.

While the bottled water industry has been growing, it has also faced challenges in the past years. The competition in this space is intensifying and there has been growing concern and, in some cases, bans on single-use plastic including plastic water bottles. The Covid-19 pandemic has also hindered bottled water sales, as reported by the Financial Times.

This article discloses the most traded bottled water companies via ESKIMO out of the ten biggest in terms of market share.

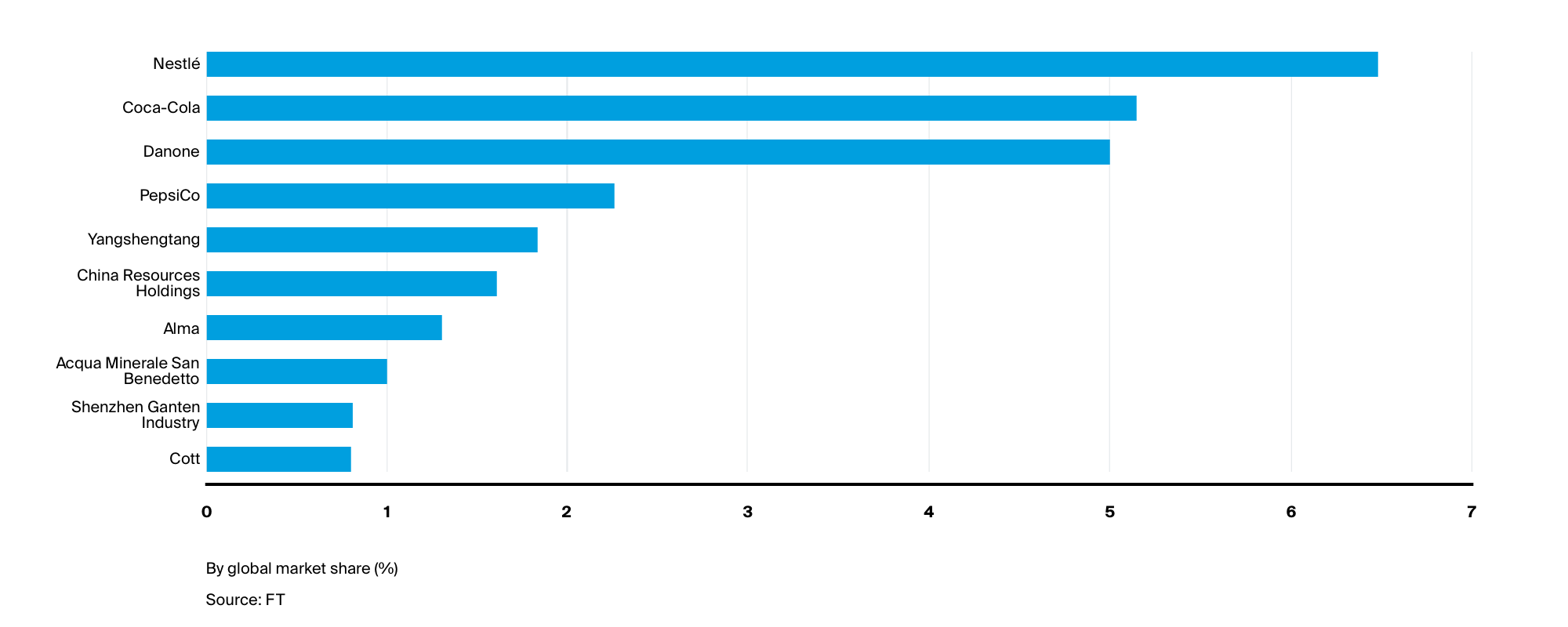

Bottled water companies with the biggest market share

The Financial Times published an article in July 2020 highlighting the companies with the biggest global market share in this industry. Of course, the companies mentioned engage in other businesses and bottled water is not their only source of revenue. Out of the ten companies, five are publicly traded including Nestlé, Coca-Cola, Dannon and Cott (Primo Water).

Most traded bottled water companies

Out of the companies above, the top-three most traded via ESKIMO from 01.01.20-29.07.20 were:

Coca-Cola

Danone

PepsiCo

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Please be aware that facts may have changed since the article was originally written.

Sources: Financial Times, Bloomberg, BCC Research, National Geographic, Allied Market Research, Euromonitor International