Before the market crash in March led by implications of the Covid-19 pandemic, the S&P 500 was off to a strong start of the year with record highs in February. Since then, the index has been climbing its way back up and on August 18th, the S&P 500 closed at an all-time high, which it has since surpassed.

While this momentum is positive, it should be taken with a grain of salt. The S&P 500 uses a free-float market capitalisation weighted methodology. This means that bigger companies carry more weight compared to smaller companies and price movements of bigger companies have a larger impact on the index’s performance. According to Bloomberg on August 12th, only about a third of S&P 500 companies were in the green since mid-February. The index’s biggest constituents have fared well during the pandemic and have been a driving force behind the S&P 500’s recovery.

Top heavy in tech

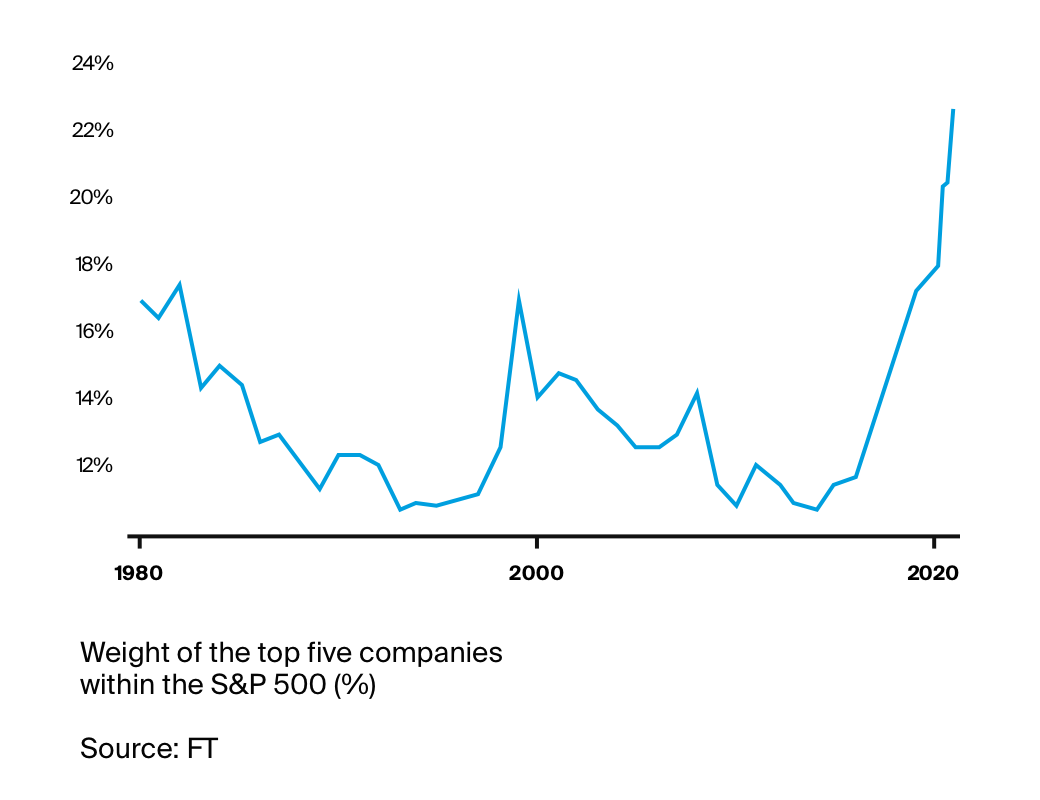

The S&P 500’s five biggest companies by market cap are Facebook, Amazon, Apple, Microsoft and Google (Alphabet), collectively known as FAAMG. The index is regularly rebalanced, so companies’ weights and sector weights change. At the time of writing, the FAAMG stocks account for nearly 25% of the index’s market cap. Five companies have not had such a large share of the S&P 500 since at least the 1980s.

FAAMG stocks outperform

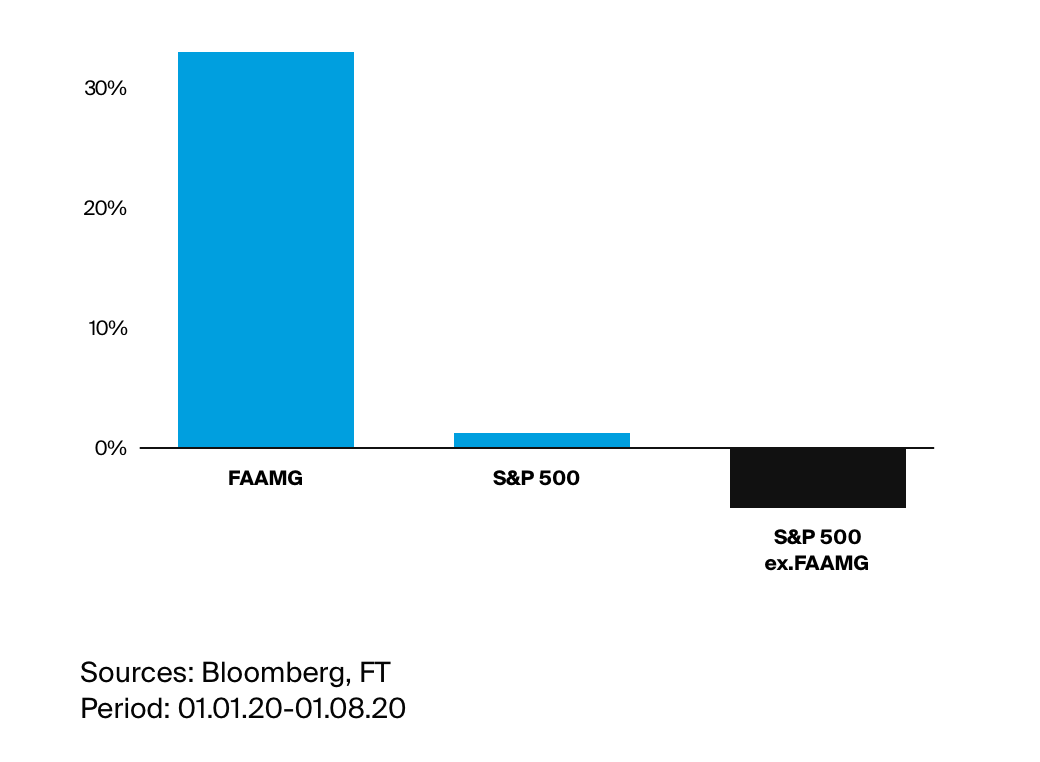

Not only do the FAAMG stocks carry a significant amount of weight in the index, but they have also been outperforming the broader index since the beginning of the year. Implications of the pandemic have pushed some investors to opt for large companies that generate revenues from online businesses, which has benefitted the FAAMG stocks.

Based on data compiled by the Financial Times, from the beginning of the year to August 1st, the FAAMG stocks increased by 33%, whereas the other 495 stocks have decreased by around 5%.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Please be aware that facts may have changed since the article was originally written.

Sources: Financial Times, Bloomberg