05 What determines the price of a stock?

Text version

Pricing financial instruments

Stocks, bonds, options; all listed financial instruments have a price. But what factors determine the price of a stock such as Volkswagen or Shell? And what is it that causes this price to rise or fall?

The initial price

For a company to grow and expand, it needs a way to fund its operations. One method for a company to raise money is to issue stocks, or equity, to the public by listing the stocks on an exchange. This will allow the public to invest money, for a small piece of ownership in return. This process is also called an Initial Public Offering or IPO. Typically, it is done in collaboration with one or more investment banks acting as an underwriter. These banks supervise the process while making an initial valuation of the company prior to the stocks being issued publicly. The bank will release an initial estimated price range for the stock value, which investors can use as in indicator when registering to first purchase these stocks. As investors come in, the starting price of the stock is determined and the first stocks are sold to the public.

Movements

Once the stock is listed on an exchange, the price will then be determined by the supply and demand of the market. This will be based on public perception and expectation, news, and company performance. For example, if a scandal emerges, investors may lose confidence and the stock price will almost certainly be pushed down. News could also play a role for certain pharmaceutical companies. If a new drug gets approval, then it is likely that the stock price of the producing company will increase. Is it rejected instead, the stock price can be expected to decline.

There can also be influence on a sector level. If a political representative announces planned expansion into infrastructure, it is likely that firms in the construction sector will benefit. Finally, geopolitical and macroeconomic factors will also impact the price of a stock. During periods of economic growth or decline, you would expect stock prices to react accordingly.

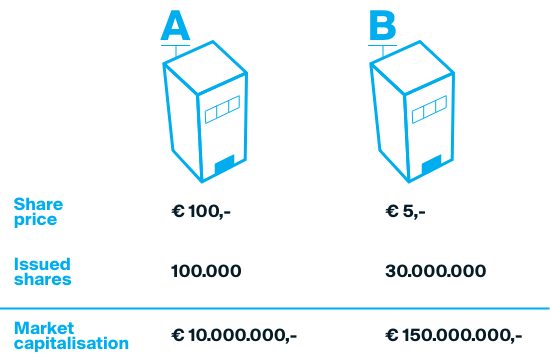

Market capitalisation

The price of a stock on its own is not an indicator of how the company is valued. That is because the total market value is dependent on the number of issued stocks. Looking at a stock priced at 100 euros, with 100.000 issued stocks, the total market capitalisation comes to 10 million. In another example with a price per stock of only 5 euros but 30 million issued stocks, the total market cap is 150 million.

Bid and Ask prices

The price per stock is also called the quote. This is the last price for which a stock has been traded, and therefore no guarantee that you can trade it again for the same amount. The bid and ask prices will be more relevant for placing an order at that moment. The highest price a buyer is willing to pay for a stock is called the bid. The lowest price a seller is willing to sell for is called the ask. Often there will be a spread between these two prices. For stocks where the perspective buyers and sellers have similar expectations of the company, this bid-ask spread can be very small. For other stocks this difference can be substantial. For example, those which do not trade as frequently or those where buyers and sellers have vastly different opinions as to its worth.

Coming up

The next lesson will cover how a stock can be valued, and what considerations will come into play when you make a trade.

Start investing today.

Start investing today.

- Incredibly low fees.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.