What are ETCs and ETNs?

Most retail investors are familiar with Exchange Traded Funds (ETFs). Less familiar are other Exchange Traded Products (ETPs), such as Exchange Traded Notes (ETNs) or Exchange Traded Commodities (ETCs). We are zooming in on these debt instruments, so you can decide if your portfolio will benefit from investing in any of them.

What are Exchange Traded Notes?

Exchange Traded Notes (ETNs) are fairly unknown types of debt securities. They were developed in 2006 by Barclays Bank. Their purpose is to make it easier for retail investors to invest in hard-to-access instruments. ETNs are designed to track the total return of an underlying market index or another benchmark. They are often unsecured. This means that they are not backed up by collateral since they do not hold the underlying asset. This type of debt creates a high risk for lenders, as they cannot be sure that the borrower repays the full amount. Similar to bonds, ETNs can be held to maturity or bought or sold at will. This type of debt instrument is continuously traded on the exchange and the prices fluctuate. In comparison to bonds, ETNs do not pay interest payments.

Every ETN has a Key Investor Document (KID). This document shows the costs, investment policy and risk of the product. Broker fees are not part of the KID but can also apply. All these costs are reflected in the returns of the investor.

What are the risks of investing in ETNs?

Investing can be rewarding but is not without risk. Different products have different risks. By investing in an ETN, for example, you can lose the full amount invested plus the incurred transaction costs. With investing in ETNs, there is a risk that the issuer (usually a bank) goes bankrupt and is not able to pay out the value of the ETN. In case the index either decreases or does not go up enough to cover the transaction fees, the amount at maturity will be lower than the amount originally invested. In this case, the ETN will not be profitable. Also, not being able to sell the position in the market at any preferred point in time is a risk while investing in ETNs.

What are Exchange Traded Commodities?

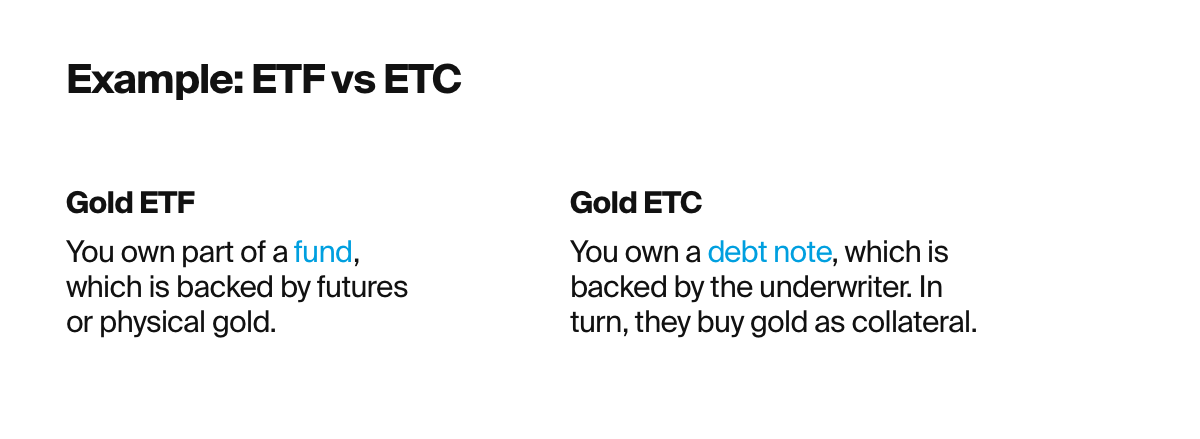

An Exchange Traded Commodity (ETC) a product name for a specific type of security. It follows individual commodities or a basket of commodities. An ETC can offer investors the possibility to invest in commodities like gold, oil, metals, energy and livestock. ETCs allow investors to invest in single markets and, like ETNs, other commodities that are often difficult for individual investors to access. Similarly to ETNs, ETCs are also a debt instrument.

Prices of ETCs fluctuate in value based on price changes of the underlying commodities. Typically, they focus on tracking the daily performance of the underlying commodity or basket of commodities and the long-term performance is usually not in the scope.

What are the risks of investing in ETCs?

Issuers of ETCs charge to invest in an ETC. These costs are embedded in the product. Like with ETNs, you can find these costs in the KID, along with the investment policy and risk of the product. Broker fees are not part of the KID but can also apply. These will be shown on the website of the broker. An ETC, by definition, follows the price of a commodity or commodity index, whereas a stock represents a small part of the ownership in a company. As you know, investing can be beneficial, but is not without risk. As an investor of an ETC, you can lose the full invested amount plus the transaction costs incurred.

Even though ETFs, ETNs and ETCs are a fairly similar type of products, certain conditions can have a great impact on changing the outcome significantly. Therefore, it is important to research the product before you add it to your portfolio. You can find key information about the composition of the fund in the prospectus and the KID. We cannot stress enough how important it is to read them carefully before investing.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products that match your knowledge and experience.

Start investing today.

Start investing today.

- Fast & Easy.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.