01 What kind of investor are you?

Text version

Entering the financial market

Once you start investing, there several things to think about. But it all starts with thinking about the kind of investor you want to be. This lesson will look at what you can consider whilst getting started, and what different investment styles can be identified.

Investing or saving

Maybe you only held a savings account till now. But savings and investments can complement one another well. When you look at the average stock market return over a long enough time frame, it becomes apparent that it has yielded a higher rate of return than the average savings account. This might be one of the reasons why investment accounts have become more popular. In these lessons, we will talk more about how investment accounts work, and which different types of financial products you can buy.

Considerations

Before you start to invest, there are a number of factors to consider. It helps to think about the risk level that you are willing to take on, and what types of products are best suited to reach your goals. For example, starting to invest when you are younger means a longer investment horizon. This is due to the extra time you have in case you need to recover from a declining stock market. Comparatively, you must be willing to take on a higher degree of risk for more returns within a short time frame.

Investment styles

Because investors will have different goals and strategies, a number of investment styles can be recognized. These can be broken down into two main categories; active investing and passive investing.

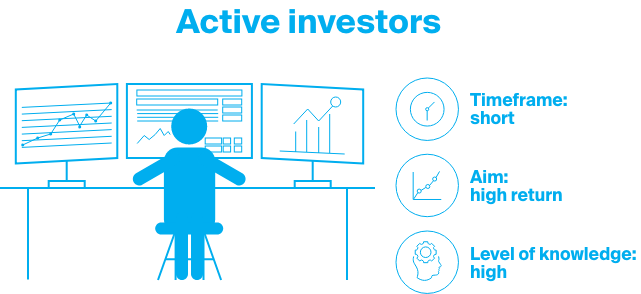

Active investing is also known as trading or speculation. These investors will spend their time monitoring stock exchanges, responding to movements in the markets, and may use more complex financial instruments like options and futures. Here, the focus is typically on the short term, and with the aim to earn a higher return than the market average. It requires significant time and knowledge. Therefore, this investment style is typically not suitable for the beginning investor.

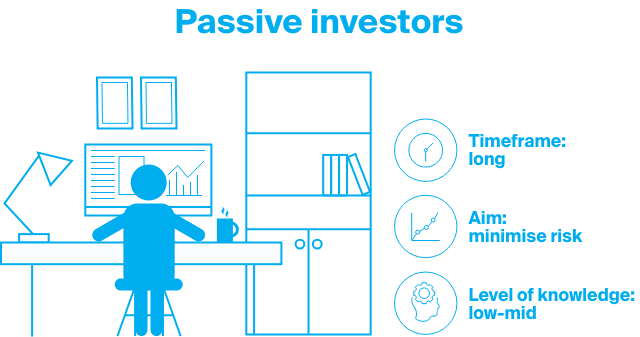

Passive investing on the other hand is focused more on investing across a longer timeframe. Those following a passive style will buy less volatile and more diversified products in order to spread the risk across investments. This way, losses of single volatile stocks can be offset by profits of others. Research is needed less frequently, and the market does not need to be continually monitored. To help you with this, there are financial instruments such as trackers to purchase a basket of stocks in a single position. By spreading your investments this way, returns will more closely follow the market average. This method of investing has become increasingly easier and for this reason popular with starting investors.

Coming up

If you plan to start managing your portfolio, you can do this based on what investment style suits you best. In the upcoming lessons, you will learn more about how this works and about the different types of financial products that are available. We will also give you more insight into the underlying fundamentals of the market and how you can get started investing.

First Lesson

Start investing today.

Start investing today.

- Incredibly low fees.

- Comprehensive tools, capabilities, and service.

- Worldwide. Anytime and anywhere.

- Secure structure.